Investing in high-end real estate has long been considered a hallmark of financial sophistication and a pathway to significant wealth. Luxury properties offer a tangible asset and a lifestyle filled with prestige and exclusivity. Understanding the market is vital to purchasing a lavish city loft or an exquisite coastal estate. This guide will equip you with essential insights and strategies to make informed decisions when investing in high-value properties.

Understanding the Market

The luxury real estate market operates differently than other sectors, with unique dynamics such as limited inventory and specialized buyer demographics. High-end buyers prioritize exclusivity, privacy, and unique architectural features, which demand a nuanced understanding of what sells in this marketplace.

Before purchasing, familiarize yourself with market conditions, such as demand-supply dynamics and regional economic health. Consider areas renowned for luxury offerings, like Tribeca homes for sale, where unique urban living appeals to affluent buyers seeking exclusive city life.

Location Matters

Location remains the cornerstone of real estate investing, especially in the high-end market. Prime locations generally retain, if not increase, their value, attributed to aspects like cultural significance, economic growth, and infrastructure development.

Luxury buyers often seek properties in metropolitan hubs or scenic environments offering extraordinary views and serenity. Urban areas with bustling business districts or access to prestigious schools attract a diverse, affluent clientele, ensuring your investment appreciates or generates high returns when resold or leased.

Financial Preparation

Investing in luxury real estate requires meticulous financial planning considering the substantial capital involved. Begin by assessing your financial health, understanding your borrowing capacity, and setting a realistic budget. High-end markets typically demand large down payments and attract higher interest rates, necessitating secure and flexible financing options.

Preapproval from financial institutions can provide an edge in competitive markets, allowing you to act swiftly when opportunities arise. Additionally, consider potential costs such as property taxes, maintenance, and insurance, each of which tends to be higher for luxury properties.

Working with the Right Professionals

Successful investments in the luxury market often hinge on securing the right team of professionals. Engage a real estate agent or broker specializing in high-end properties; their expertise and network can offer invaluable market insights and identify opportunities unavailable to the general public.

Likewise, collaborate with legal advisors experienced in negotiating complex deals and ensuring compliance with pertinent regulations. Financial advisors and appraisers can offer guidance on maximizing tax benefits or determining a property’s value, ensuring an informed and smooth transaction process.

Keeping an Eye on Market Trends

Attuning to market trends enables investors to spot lucrative opportunities and make strategic decisions. Track shifts in buyer preferences that may influence the demand for certain property types or features. Factors such as technological advancements, sustainability, and health-conscious designs increasingly appeal to luxury buyers and can influence market dynamics.

Regularly reviewing market reports and industry forecasts ensures your investment is profitable and aligned with future market trajectories, setting it up for stronger appreciation over time.

Evaluating Amenities and Features

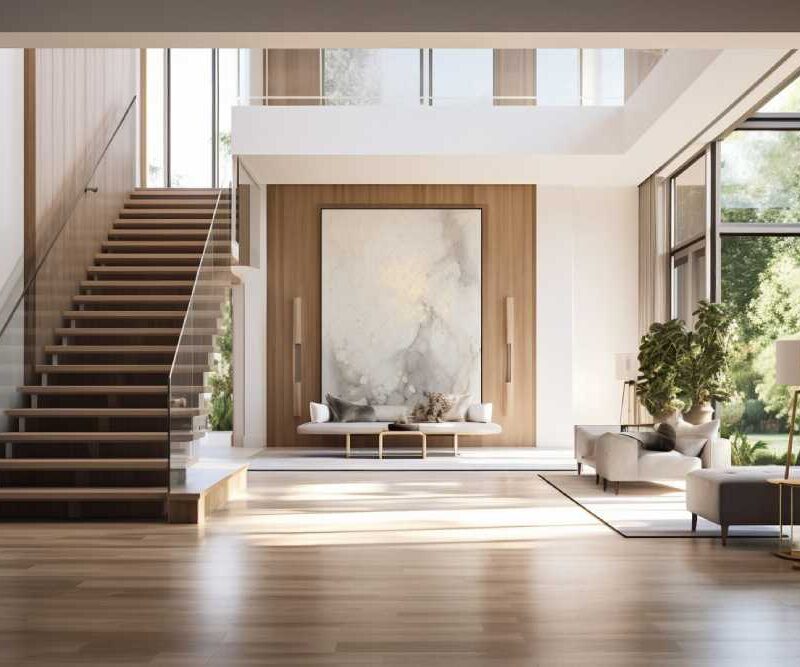

Discerning buyers expect more than an impressive structure when it comes to high-end real estate. Amenities play a significant role in defining a property’s value and appeal. Evaluate rare offerings like private gyms, home theaters, infinity pools, or smart home technologies that significantly enhance a luxurious lifestyle.

Premium features include natural light optimization, noise insulation, and superior security measures. Assess how these elements add value to the property, distinguishing it from others and enhancing its marketability.

Exit Strategy

Crafting a clear exit strategy is paramount to ensure the long-term success of your real estate investment. Even in a robust market, circumstances may change, requiring you to liquidate assets quickly. Plan whether you intend to hold the property for a certain period, lease it, or eventually sell it for profit.

Understanding market liquidity and having a timeline can ensure you’re optimally positioned to execute your strategy. Leverage insights from seasoned investors and market data, allowing you to adapt the strategy according to market conditions and personal financial goals.

Conclusion

Investing in high-end real estate requires a strategic approach encompassing market understanding, financial planning, and collaboration with trusted professionals. By focusing on prized locations, recognizing the importance of unique amenities, and remaining vigilant about market trends, investors can capitalize on opportunities within the luxury sector.

An aptly timed exit strategy further underscores the importance of forward-thinking. With thoughtful preparation and a keen eye on evolving dynamics, high-end real estate is a rewarding segment for investors aiming to diversify their portfolio with distinctive assets.