Invoice processing refers to the process by which incoming supplier invoices are handled from receipt until paid and recorded in the general ledger. It’s typically done by accounts payable (AP) teams using the software. Timely invoice processing helps you leverage early payment discounts and control operating cash flow. It also saves money spent on AP salaries and other administrative costs.

Invoice Receiving

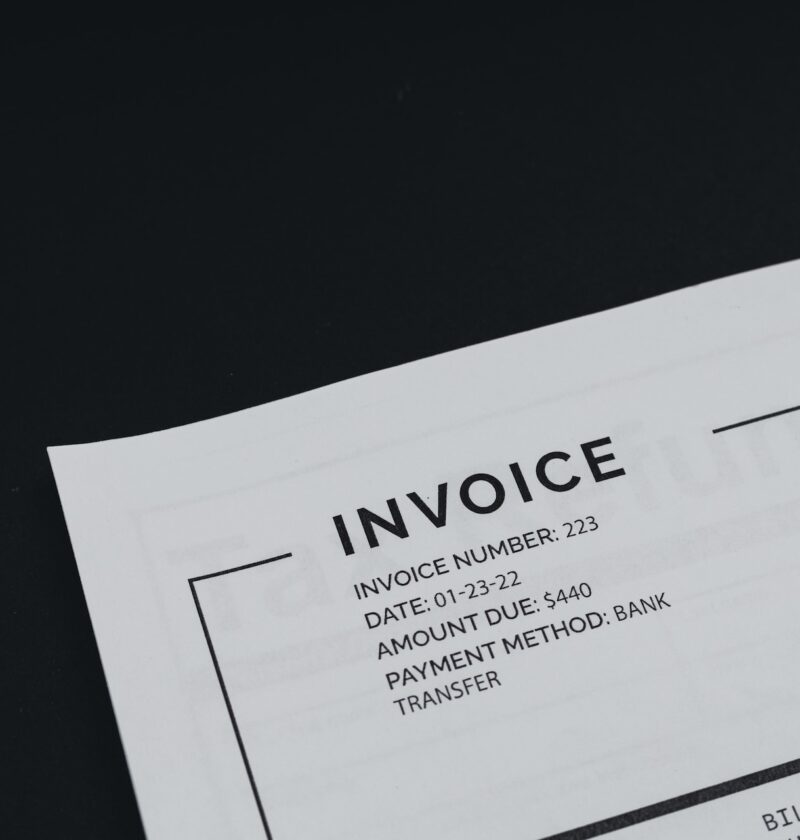

Invoice processing is a collection of overlapping processes encompassing supplier invoices from when they arrive until they’re paid and recorded in your books. This accounts payable management function includes everything from data capture to invoice approval workflows, and many of these invoice-related tasks are ripe for automation. Invoices can arrive in any form—paper, PDFs, or e-invoices—and must be manually scanned or entered into your accounting system before being matched with your existing purchase orders and delivery receipts. This process is essential for ensuring you receive what you’re paying for and not getting charged for things you didn’t receive or didn’t order.

Once all the invoice details have been compared and verified, it’s time to begin scheduling them for payment. It is an essential step in invoice processing because it ensures that bills will be paid promptly. Maintaining positive relationships with suppliers who need their cash flow to invest in new equipment and materials to keep producing quality products and services for you is essential. Optimal invoice processing also helps your organization avoid payment fraud, which can be costly and embarrassing.

Automating the invoice approval process creates a secure, backed-up trail of activity that can be reviewed and referenced for audit or compliance purposes, making you less likely to experience these financial headaches. All these can ultimately reduce or eliminate duplicate invoices — saving your company a lot of time and money.

Invoice Entry

Once the invoice has been scanned or manually entered, it’s ready to be checked against the purchase order and delivery receipt to make sure all the information is correct. Any discrepancies must be addressed and resolved before the invoice can be approved for payment by account. Enter the invoice into your accounts payable system. It is typically done by an AP clerk, bookkeeper, or, in smaller businesses, even a receptionist. It is mainly done in a manual process. The good news is that invoice processing can be automated using an accounts payable automation software solution, which shortens the workflow and streamlines the entire system. An invoicing and payment processing software can also reduce paperwork and filing costs by digitizing and storing all invoices, payments, and documents in one secure place. It creates more efficiency in your AP department and saves time, money, and space. Optimizing invoice processing and implementing an effective workflow is crucial to maintaining strong vendor relationships and legal protections. It also helps your company manage cash flow and stay within its budget, ensuring all outstanding debts are paid on time so you can continue to grow your business. It can lead to better business relationships, more competitive prices, and a healthier supply chain.

Invoice Payment

After the invoice is digitized (either manually or automatically), it needs to go through a verification process where it’s checked against the original purchase order and shipping receipt. It helps identify discrepancies and prevents the incorrect invoice amount from being paid. After verifying the invoice’s information, it’s ready for approval. The accounts payable department typically routes the invoices for approval to different staff members based on their expertise or relationship with the vendor. Ensure all invoices get the attention they deserve and are paid on time. The invoice is then processed for payment using the company’s preferred payment method. It could be a check, ACH, or wire transfer. For more modern companies, payments are often made through mobile wallets or unified payment interfaces.

Finally, the invoice is then recorded in the general ledger. It is a final step that ensures the transaction is recorded correctly and accurately in the company’s accounting records.

Streamlining the invoice process and establishing an organized payment structure is a must for businesses. It benefits the accounts payable department by increasing their productivity and efficiency. It helps ensure that suppliers are paid on time so that cash flow remains healthy for all parties involved in the supply chain.

Invoice Archiving

Invoice processing is your team’s formal accounting process for incoming sales invoices, from receiving them to payment and recordkeeping. It’s a highly complex and labor-intensive task for most accounts payable teams, often requiring significant time and effort to ensure all the information is captured, correctly stored, and accessible when needed. A critical chink in the chain can occur when essential invoices are misfiled or lost, and this can quickly lead to bottlenecked cash flow, diminished working capital, and strained vendor relationships. Fortunately, there are ways to streamline and automate invoice processing and remove inefficiencies.

Moving to a paperless workflow could eliminate costly processing delays by automatically uploading sales invoices electronically. It allows a company to store all invoice data in one place, critical for different comparison and reporting tasks. It also reduces storage space needs and provides superior security by encrypting invoice data and keeping backups online.

In addition, e-invoicing can help you meet legal obligations and compliance requirements for various countries with native advanced translation and communication functionality and archiving capabilities that are audit-proof and GoBD-compliant. For example, the easy invoice archiving feature lets you easily export and archive a PDF copy of any customer document printed in live print mode from the document home page.