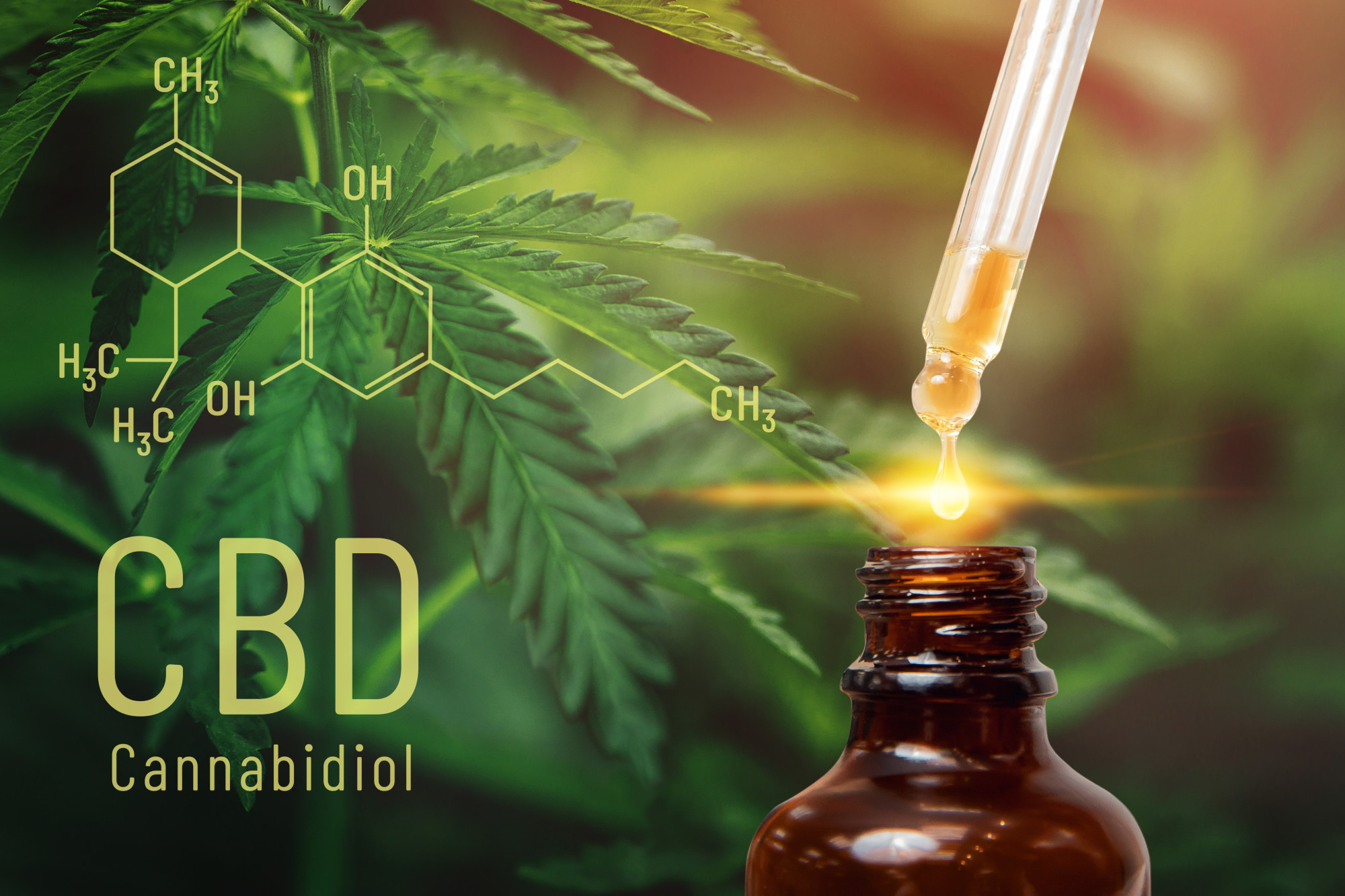

The cannabis industry is booming, but securing financing for a cannabis business comes with unique hurdles. Regulatory complexities, legal issues, and stigma still plague the industry, and for enthusiastic entrepreneurs, navigating the financial waters to secure capital is fraught with challenges.

Here’s a roadmap to sidestep common pitfalls when seeking cannabis business financing venture:

Inadequate Business Plan

One big thing that can trip folks up is not having a killer business plan. Think of it like going on a road trip without a map – you’re going to end up lost. Your plan’s got to talk numbers, like how much dough you need and how you’ll make it back.

Plus, it’s got to show you know your stuff about weeds and laws. If your plan looks like a half-baked cookie recipe, those money folks will skip over you faster than a rabbit on a date. So, slap on that thinking cap and make it solid, like concrete.

Ignoring Regulatory Requirements

Skipping out on regulatory homework is asking for trouble. In the cannabis startup the rules are tighter than a drum. Every state’s got its maze of laws; slip up and you could be belly up. A smart move? Get a legal eagle who knows their pot policy.

They’ll keep you in line, so when you’re talking shop with the money heads, you’re not just blowing smoke. Remember, the suits with the cash love one thing: playing it safe. Show them you’re not a gamble because you’ve got the regs down cold.

Failing to Understand the Financial Model

Getting hip-deep in the cannabis investment without a solid grasp of your financial operation is like surfing blindfolded – a wipeout waiting to happen. Cash flow, cost structures, profit margins – these aren’t just fancy terms, they’re the bread and butter of your business.

If you’re foggy on the numbers, potential financiers will be turning tail quicker than you can say “green.” To avoid this, ensure every last penny is accounted for in your projections.

And hey, if you’re feeling lost in the financial weeds, learn about cannabis loans to get the lowdown on securing that green for your greenery business.

Not Exploring Various Funding Sources

Check it, sticking to one spot to get your cash is like eating nothing but crackers for dinner – not the sharpest move. You have to hustle and look under every rock because there’s a whole party of places to get funds. There’s the usual bank stuff, but they might give you the cold shoulder.

Don’t sweat it though, because there are more doors to knock on – like investors who’re totally into the ganja game, or crowdfunding where a bunch of peeps chip in. And hey, don’t ignore pals and fam; they might be down to back you up.

So, spread out, shake every tree, and see where the money falls. You do you and find those bucks wherever they are hiding.

Lack of Industry Expertise

Look, diving into the weed biz without knowing your stuff is like trying to fly a plane without lessons – you going to crash and burn. If your head isn’t filled with cannabis smarts, those with purse strings will sniff out your game quickly.

They want to see you’ve studied the strain science, the market moves, and know your Kush from your Haze. So, get down with the growers, chat up the sellers, and take notes like a pro.

School yourself until you can talk about terpenes and THC levels in your sleep. Money folks dig confidence backed by hardcore know-how. Hit the books, get schooled, and get ready to impress.

Ineffective Networking

Networking’s the secret sauce, but if you’re just chilling in your comfort zone, you’re missing out big time. It’s about mixing with the right crew, not just your homies.

When you don’t spread out, your business is invisible to the big fish – the ones with the fat wallets and the power to boost your growth.

You have to hit up events, rub elbows with industry hotshots, and slide into those DMs like you mean it. If you think you can slack on shmoozing, think again. It’s simple – no talkie, no money. Ain’t no one going to throw cash at a stranger.

Neglecting Due Diligence

Failing to do your homework on the legal and financial ins and outs? Big no-no. Skipping the fine-tooth-comb routine means you could miss a monster hiding in the details. Due diligence is like your trusty flashlight in a haunted house.

You have to poke around every dusty corner of your biz plans and the folks you’re dealing with. Without digging into the nitty-gritty, you might as well kiss your cash goodbye – investors aren’t touching a hot mess with a ten-foot pole.

Don’t be that person who trips over their laces because they didn’t double-knot them. Do the grunt work, and it’ll pay off when the money starts rolling in.

Poor Risk Management Strategies

Do you know how sometimes folks cross the street without looking both ways? Well, that’s pretty much what you’d be doing in the cannabis biz if you ignore risk management. You can’t just toss seeds and hope for the best – risks are all over the place, like pests in your plants.

If you don’t have a plan for when things hit the fan, you might as well be throwing your money in a bonfire. So, you need to be like a ninja, always on your toes, ready to handle stuff like bad crops, legal changes, or prices dropping like a stone.

Don’t play the guessing game with risk; treat it like a chess match and plan a few moves ahead.

Learn All About Cannabis Business Financing

Alright, wrapping this up: cannabis business financing is tough but doable. Nail your business plan, know the rules and numbers, look for cash in all places, level up your weed game, network like a boss, check the fine print, and handle risks like a pro. Do all that, and you’re golden. Now go get that green!

Did you find this article helpful? Check out the rest of our blog.